Investing in the stock market can be daunting, especially with the influx of financial data and predictions. Sofi Technologies Inc. (NASDAQ: SOFI), a prominent player in the fintech space, has garnered substantial attention in recent years. As a result, many investors are eager to understand the reliability of Sofi stock price predictions to make informed decisions. In this detailed review, we delve into the accuracy of Sofi stock price predictions, the factors influencing these predictions, and what investors should consider before making moves.

Understanding Sofi Technologies Inc.

Sofi Technologies is a financial technology company offering various services, including loans, credit cards, investing, and banking. Known for its innovative approach and member-first ethos, Sofi has rapidly become a favorite among millennials and Gen Z.

With its expansion into new financial services and continuous growth, Sofi’s stock has been constantly evaluated by analysts and investors. Understanding the company’s fundamentals is essential before dissecting stock price predictions.

What Influences Sofi Stock Price Predictions?

Stock price predictions are based on various factors. For Sofi, these include:

Financial Performance

Sofi’s quarterly earnings reports significantly influence stock predictions. Metrics like revenue growth, profitability, and member acquisition rates play pivotal roles.

Market Sentiment

Market perception of fintech companies affects Sofi stock. Joyous news, like partnerships or product launches, can boost predictions, while negative news can deflate optimism.

Macroeconomic Factors

Economic conditions, interest rates, and inflation directly impact the fintech industry. Rising interest rates can affect Sofi’s loan business, which could lead to revised stock predictions.

Competition

Sofi faces competition from other fintech companies and traditional financial institutions. Analysts consider how well Sofi positions itself against competitors when forecasting its stock price.

Regulatory Environment

Changes in financial regulations can alter Sofi’s growth trajectory and influence stock price predictions.

How Do Analysts Make Sofi Stock Predictions?

Financial analysts use several tools and methodologies to predict stock prices. These include:

Fundamental Analysis

This approach evaluates Sofi’s financial statements, revenue, earnings, and overall business health. Analysts assess whether the stock is undervalued or overvalued compared to its market price.

Technical Analysis

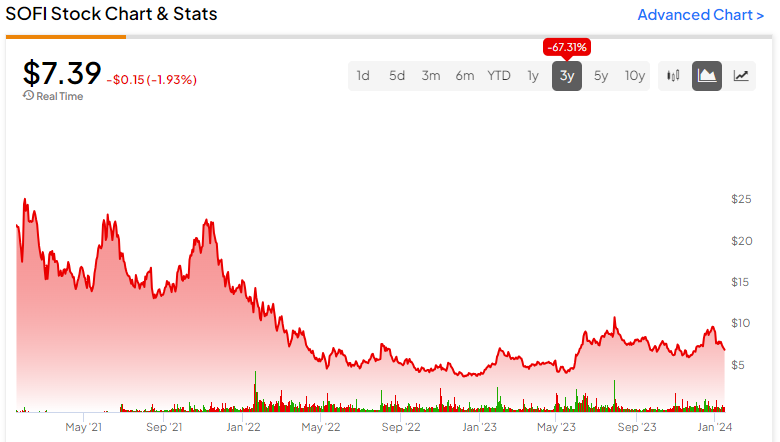

This method uses historical price data and trends to predict future stock movements. Analysts look for patterns in Sofi’s stock chart, such as resistance levels and moving averages.

Sentiment Analysis

Analysts gauge public and investor sentiment around Sofi by monitoring social media, news, and market commentary.

Discounted Cash Flow (DCF) Models

DCF models estimate Sofi’s intrinsic value by projecting future cash flows and discounting them back to the present value.

Comparative Analysis

Comparing Sofi to its competitors helps analysts understand its market position and growth potential, influencing price predictions.

Are Sofi Stock Price Predictions Accurate?

Stock price predictions, including those for Sofi, are only partially accurate. Predictions are influenced by numerous dynamic factors that can change unexpectedly. Here’s a closer look at the accuracy of these predictions:

Short-Term Predictions

Short-term predictions for Sofi stock are often based on immediate events, such as earnings reports or product launches. Since these predictions rely on current data, they tend to be more accurate. However, market volatility can still disrupt these forecasts.

Long-Term Predictions

Long-term predictions are less reliable due to the many uncertainties that could arise. Factors like technological advancements, market disruptions, and economic changes make it challenging to predict Sofi’s stock price over an extended period.

Analyst Bias

Analyst predictions can sometimes be biased, reflecting overly optimistic or pessimistic outlooks. This highlights the need for investors to evaluate multiple sources.

Tips for Investors Evaluating Sofi Stock Predictions

Diversify Your Sources

Don’t rely on a single analyst or platform for predictions. Consider reports from reputable financial institutions, independent analysts, and market platforms.

Stay Updated

Monitor Sofi’s performance, news, and industry developments regularly. Staying informed can help you better evaluate predictions’ accuracy.

Analyze Historical Performance

Reviewing Sofi’s past stock trends and comparing them to predictions can provide insights into the reliability of analysts.

Understand Market Trends

Broader market trends, such as shifts in the fintech industry or macroeconomic conditions, can significantly impact Sofi’s stock.

Consider Long-Term Potential

Instead of focusing solely on short-term predictions, assess Sofi’s long-term growth potential and ability to adapt to market changes.

Conclusion

Sofi stock price predictions are valuable tools for investors but should not be taken as absolute truths. While analysts strive to provide accurate forecasts, the stock market’s inherently volatile nature means that predictions often serve as guidelines rather than guarantees.

Investors should approach these predictions critically, combining them with thorough research and market understanding. Investors can make informed decisions about Sofi stock by diversifying sources, staying updated, and focusing on long-term growth.

FAQs About Sofi Stock Price Predictions

1. Are stock price predictions for Sofi reliable?

Stock price predictions for Sofi provide valuable insights but are only partially reliable due to market volatility and unforeseen factors.

2. What tools do analysts use to predict Sofi’s stock price?

Analysts use fundamental analysis, technical analysis, sentiment analysis, discounted cash flow models, and comparative analysis to predict Sofi’s stock price.

3. How often should investors check Sofi stock price predictions?

Investors should monitor predictions regularly, especially around major events like quarterly earnings reports or market changes.

4. What factors can disrupt Sofi stock price predictions?

Macroeconomic changes, regulatory updates, industry competition, and unexpected company news can disrupt predictions.

5. Is relying on short-term or long-term predictions for Sofi better?

Short-term predictions are often more accurate due to their reliance on current data, but long-term predictions can provide insights into growth potential.

You May Also Read: https://timebusinesswork.com/fintechzoom-tsla-stock/

Leave a Reply